Deciphering the Data Dilemma: Top Challenges Community Banks Face Today

Written by

Mike Galvin, CEO & Co-Founder

Published

September 13, 2023

Community banks have long served as the backbone of local economies—trusted partners to small businesses, families, and individuals. Their deep-rooted presence and personal relationships have made them invaluable in understanding the unique needs of their communities. But today, that legacy is being tested.

As larger financial institutions and fintech startups race ahead with cutting-edge technology and data-driven services, community banks face mounting pressure to keep pace. Customers now expect seamless, personalized digital experiences—and meeting those expectations is no longer optional. It’s essential for survival.

Banking’s Top Data Challenges

The digital era brings with it immense opportunities, but also new challenges, especially for community banks. The heart of these challenges often revolves around data—how it’s collected, stored, analyzed, and utilized. Let’s delve into the specific data hurdles community banks are grappling with and explore potential solutions.

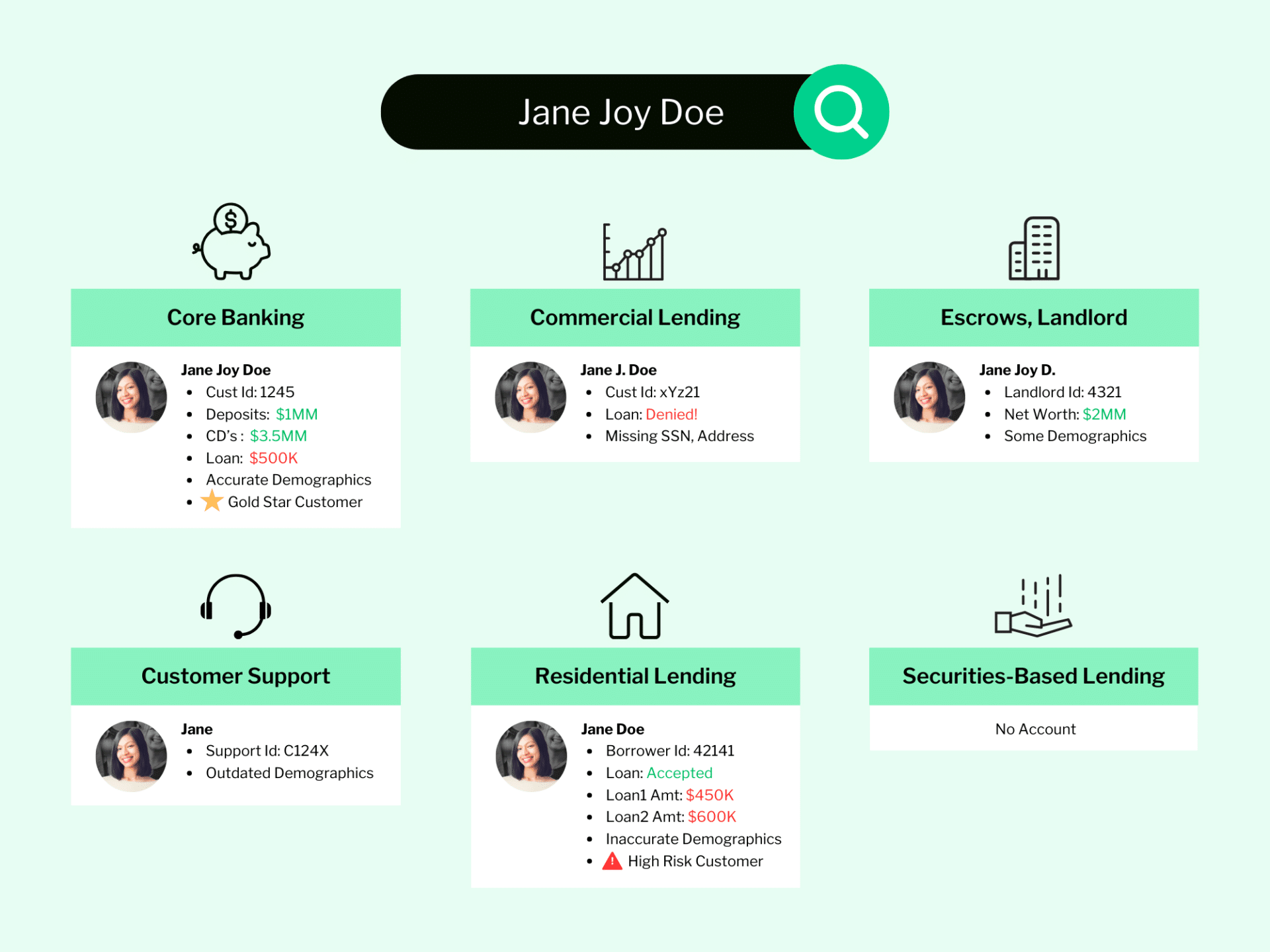

Fragmented Data Systems

Community banks often struggle with managing data spread across multiple systems. This fragmentation not only causes inconsistencies but also deprives banks of a unified 360-degree view of their customers. As a result, they miss out on leveraging holistic insights for effective cross-selling, up-selling, and tailored service offerings.

Inadequate Customer Insights

A disjointed data system makes it difficult to extract meaningful insights about customers. Without a comprehensive understanding of customer behaviors, preferences, and needs, community banks face challenges in designing products and services that resonate with their clientele.

Operational Inefficiencies Due to Data Disparities

A disjointed data system makes it difficult to extract meaningful insights about customers. Without a comprehensive understanding of customer behaviors, preferences, and needs, community banks face challenges in designing products and services that resonate with their clientele.

Navigating Regulatory & Compliance

With the ever-evolving landscape of financial regulations, community banks face the daunting task of ensuring their data practices comply with these standards. Disparate data systems make it harder to adhere to regulatory norms, increasing the risks of non-compliance and potential repercussions.

The Digital Competence Gap

As fintech solutions and larger banks tap into advanced data analytics, AI, and other digital innovations, community banks may feel left behind. Embracing digital transformation is no longer optional; it’s a necessity to meet modern customer expectations and stay competitive.

Navigating the Future with Community Bank 360°

To effectively address these data-related challenges, community banks need a comprehensive strategy. Enter OneSix’s Community Bank 360°, a dedicated solution tailored for community banks to harness their data. This solution offers:

- A unified data platform to centralize data, eliminating gaps and providing a consolidated customer view.

- In-depth customer analytics through Power BI integration, enabling banks to visualize complex data patterns and extract actionable insights.

- Scalable and flexible infrastructure that adapts to changing data needs, ensuring efficiency. It’s powered by Matillion, allowing banks to tailor the solution to their unique operational requirements.

- Holistic training and support ensuring banks maximize the utility of Community Bank 360°.

Community Bank 360° is more than a tech upgrade. It equips banks with the requisite tools and insights to not only remain competitive but also to chart an innovative path towards sustainable, data-driven growth. It’s a strategic guide for community banks in a digital world. By adopting this approach, banks can not only enhance customer relations but also ensure sustainable growth in a challenging market environment.